Financial Information

Management Index Data

If you want to know in more detail, please refer to Investors' Data Book 2024.

Financial Highlights (Consolidated)

Note) Figures are rounded down in principle.

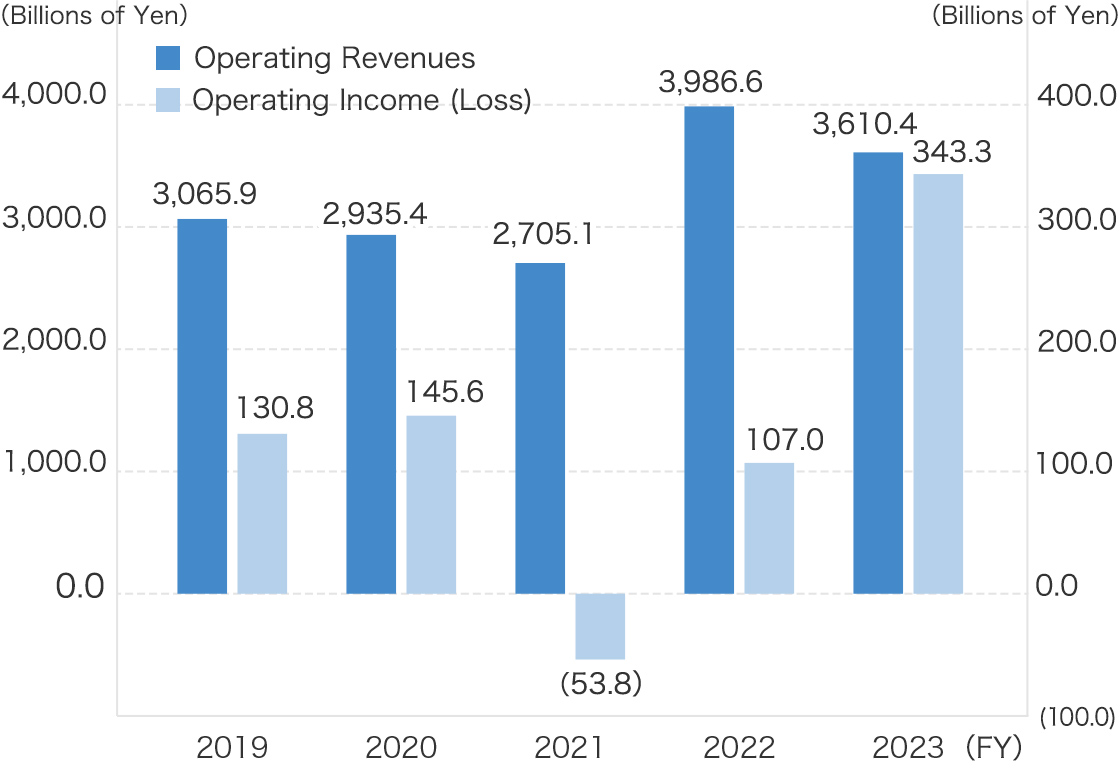

| Operating Revenues / Operating Income (Loss) |

|---|

|

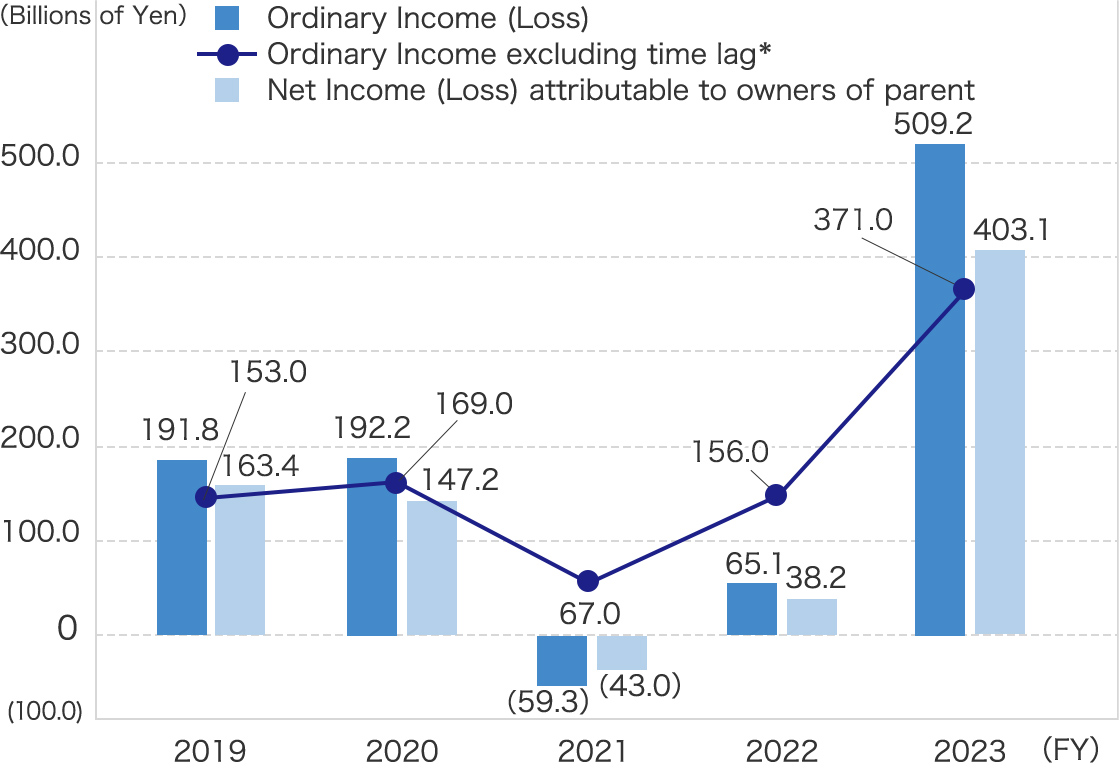

| Ordinary Income (Loss) / Ordinary Income excluding time lag / Net Income (Loss) attributable to owners of parent |

|---|

|

*Ordinary Income excluding time lag : Approx. Billions of Yen.

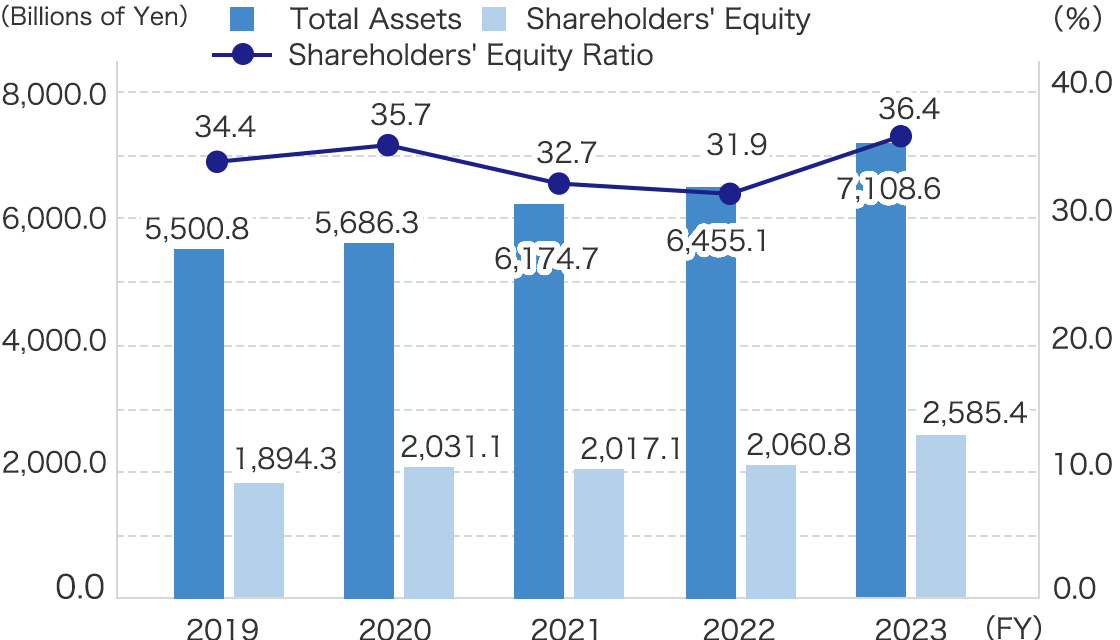

| Total Assets / Shareholders' Equity / Shareholders' Equity Ratio |

|---|

|

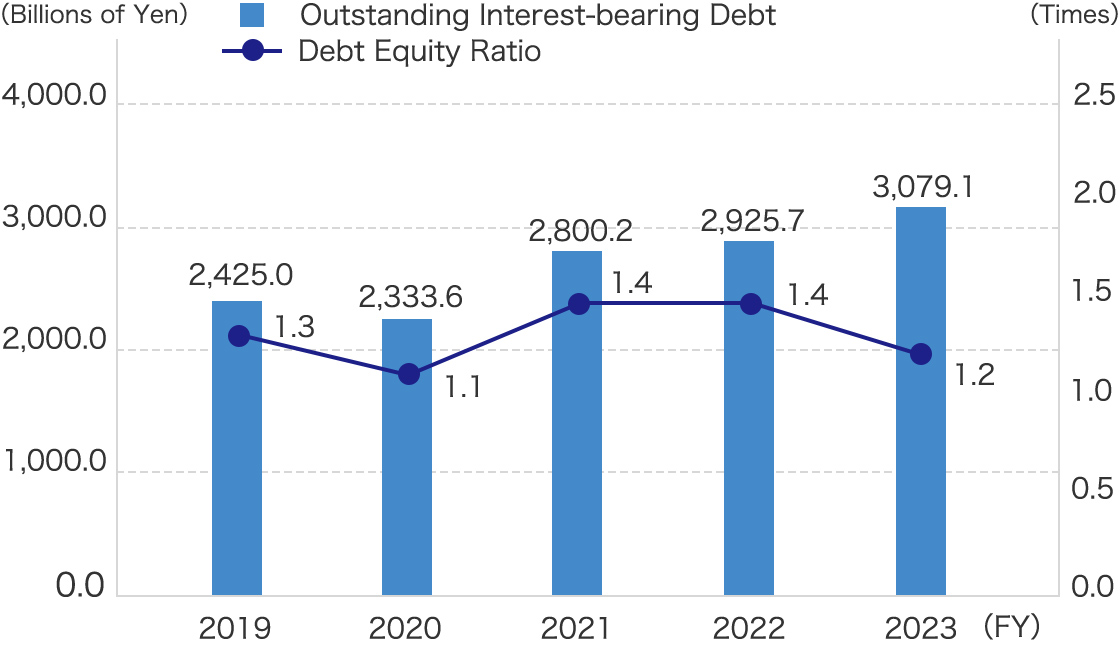

| Outstanding Interest-bearing Debt / Dept Equity Ratio |

|---|

|

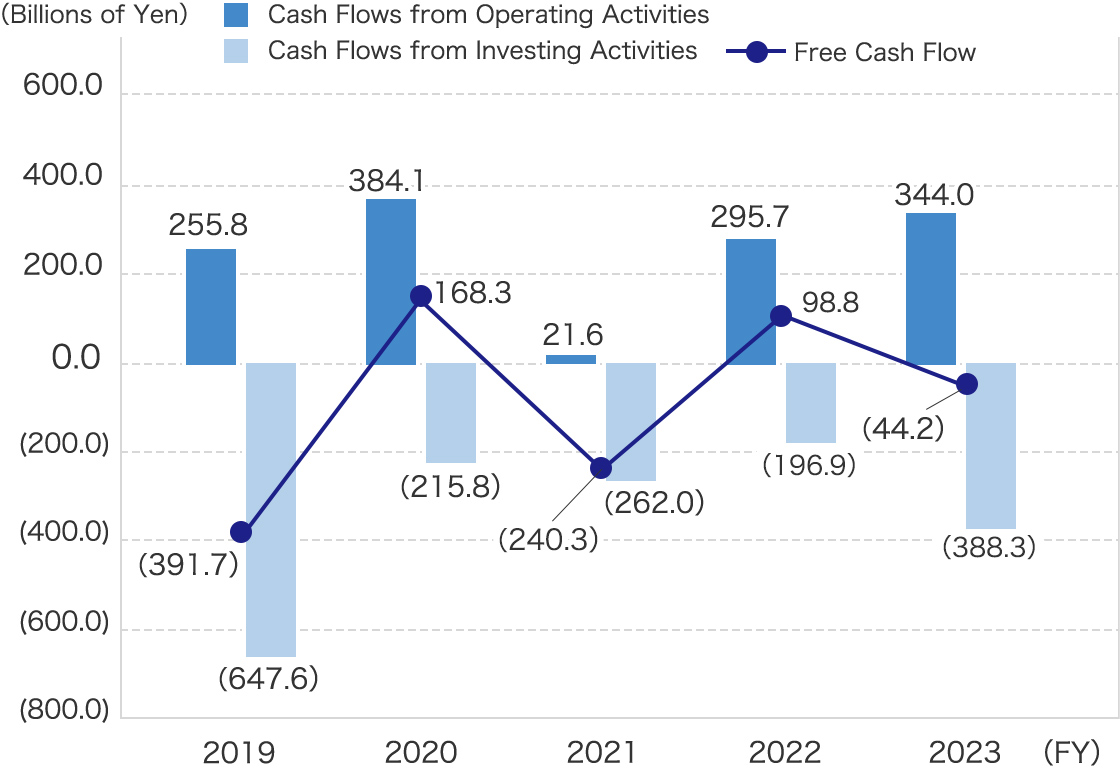

| Cash Flows from Operating Activities / Cash Flows from Investing Activities / Free Cash Flow |

|---|

|

(Billions of Yen)

| Consolidated Financial Data | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 |

|---|---|---|---|---|---|

| Operating Revenues | 3,065.9 | 2,935.4 | 2,705.1 | 3,986.6 | 3,610.4 |

| Operating Income (Loss) | 130.8 | 145.6 | (53.8) | 107.0 | 343.3 |

| Ordinary Income (Loss) | 191.8 | 192.2 | (59.3) | 65.1 | 509.3 |

| <Ordinary Income excluding time lag> (Approx. Billions of Yen) | <153.0> | <169.0> | <67.0> | <156.0> | <371.0> |

| Net Income (Loss) attributable to owners of parent | 163.4 | 147.2 | (43.0) | 38.2 | 403.1 |

| Total Assets | 5,500.8 | 5,686.3 | 6,174.7 | 6,455.1 | 7,108.6 |

| Shareholders' Equity | 1,894.3 | 2,031.1 | 2,017.1 | 2,060.8 | 2,585.5 |

| Outstanding Interest-bearing Debt | 2,425.0 | 2,333.6 | 2,800.2 | 2,925.7 | 3,079.1 |

Index Highlights (Consolidated)

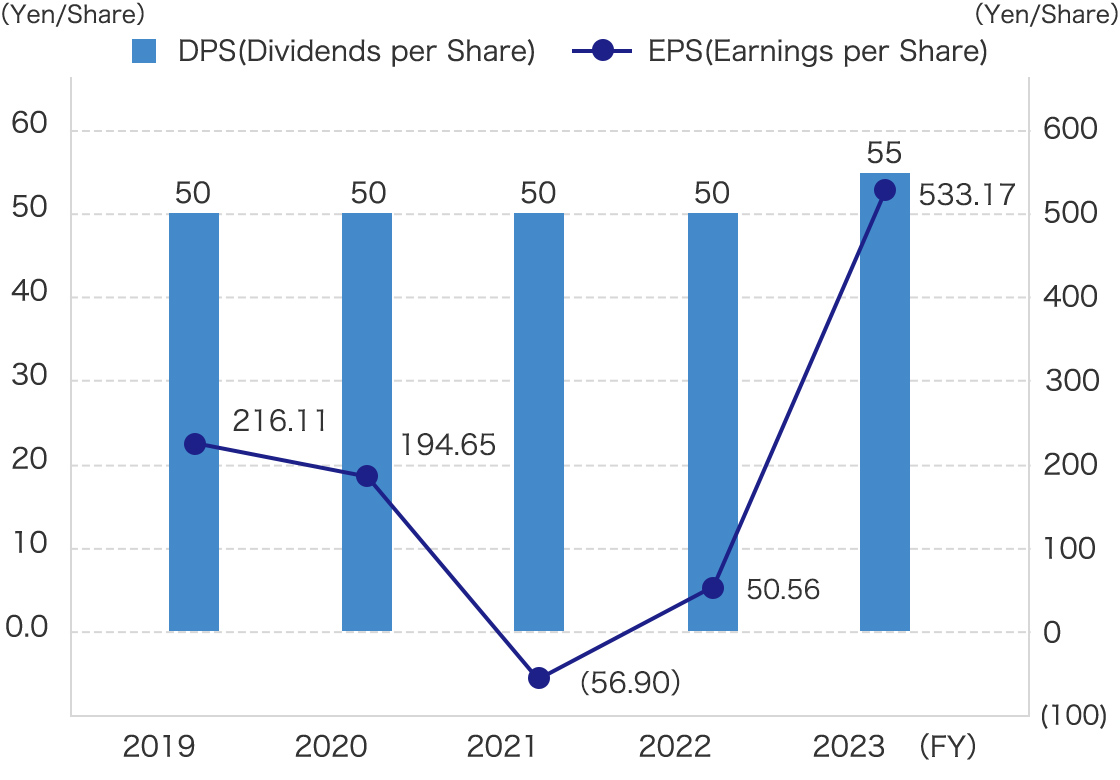

| DPS (Dividends per Share) / EPS (Earnings per Share) |

|---|

|

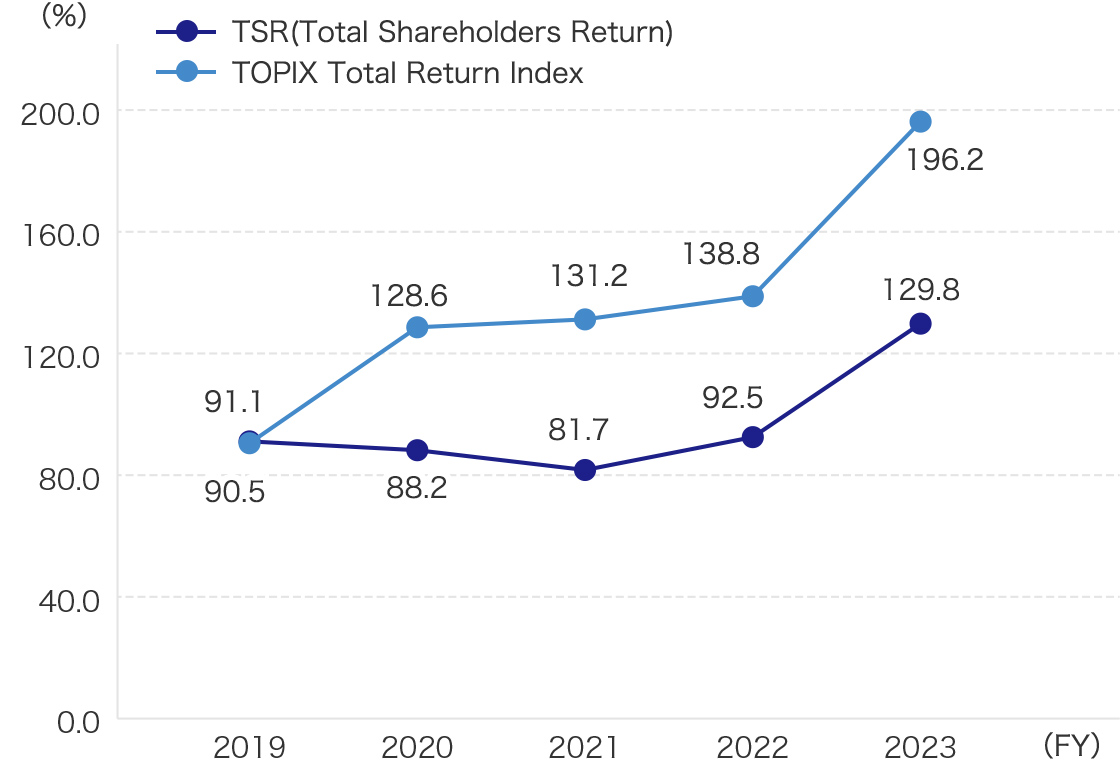

| TSR (Total Shareholder Return) / TOPIX Total Return Index |

|---|

|

| ROA (Return on Assets) *Excluding time lag |

|---|

|

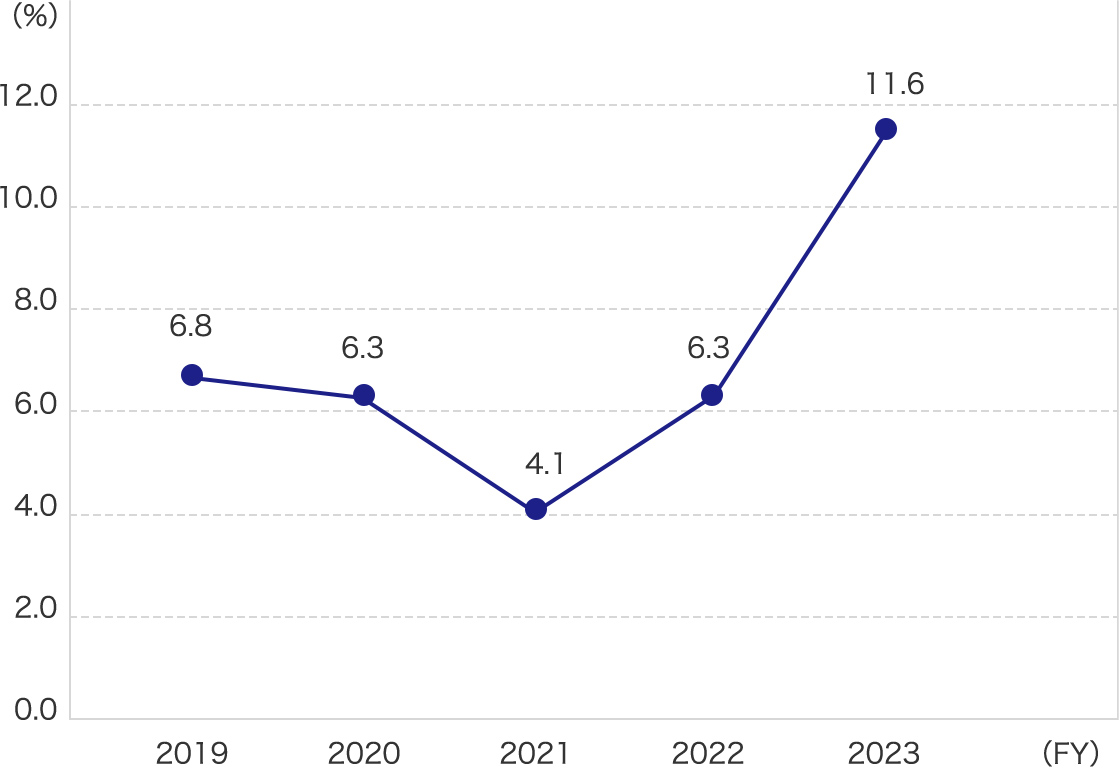

| ROE (Return on Equity) *Excluding time lag |

|---|

|

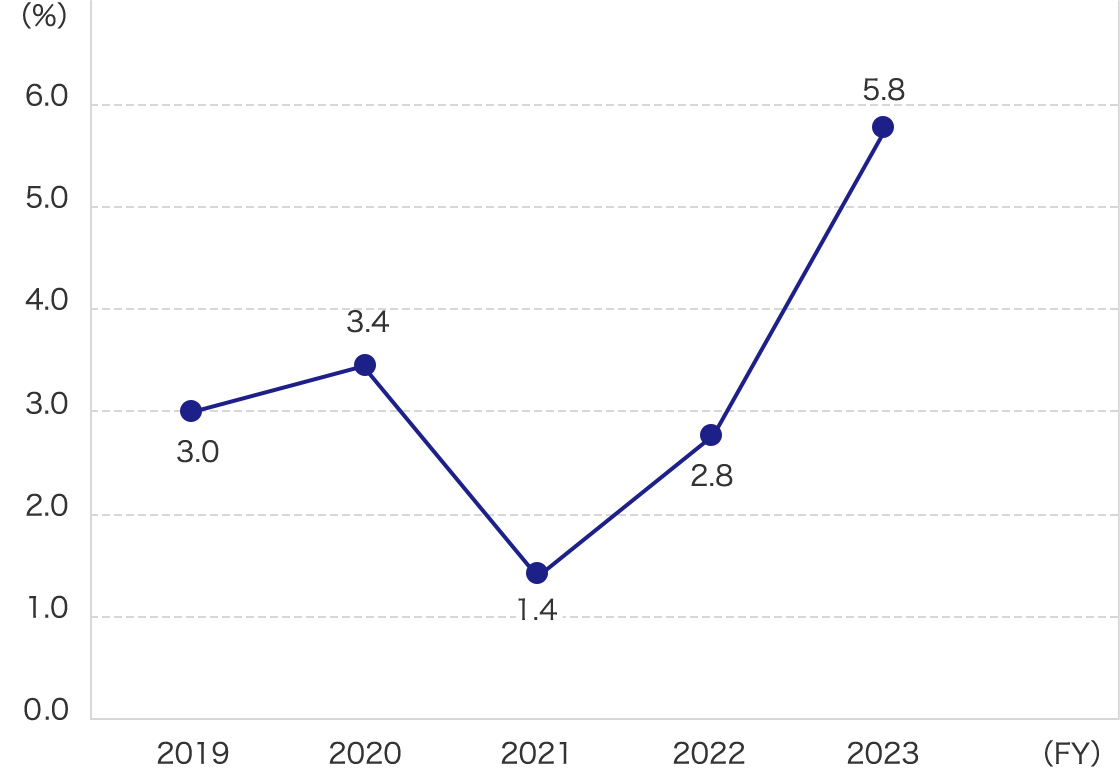

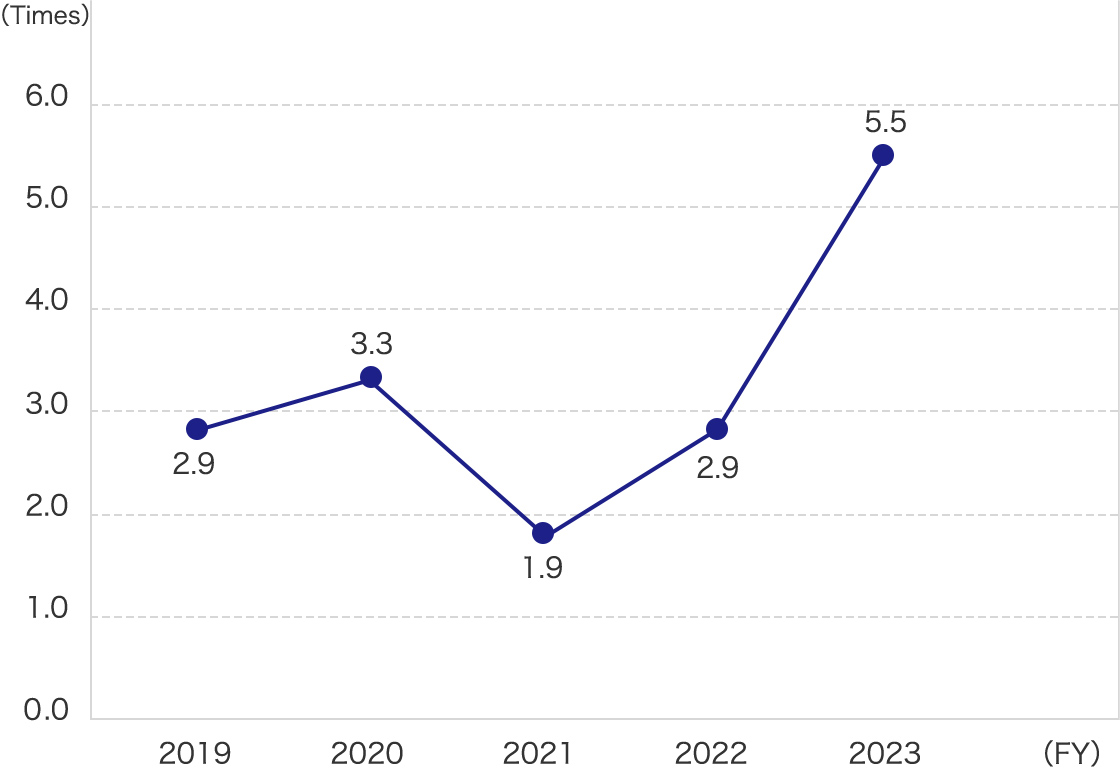

| ROIC (Return on Invested Capital) *Excluding time lag |

|---|

|

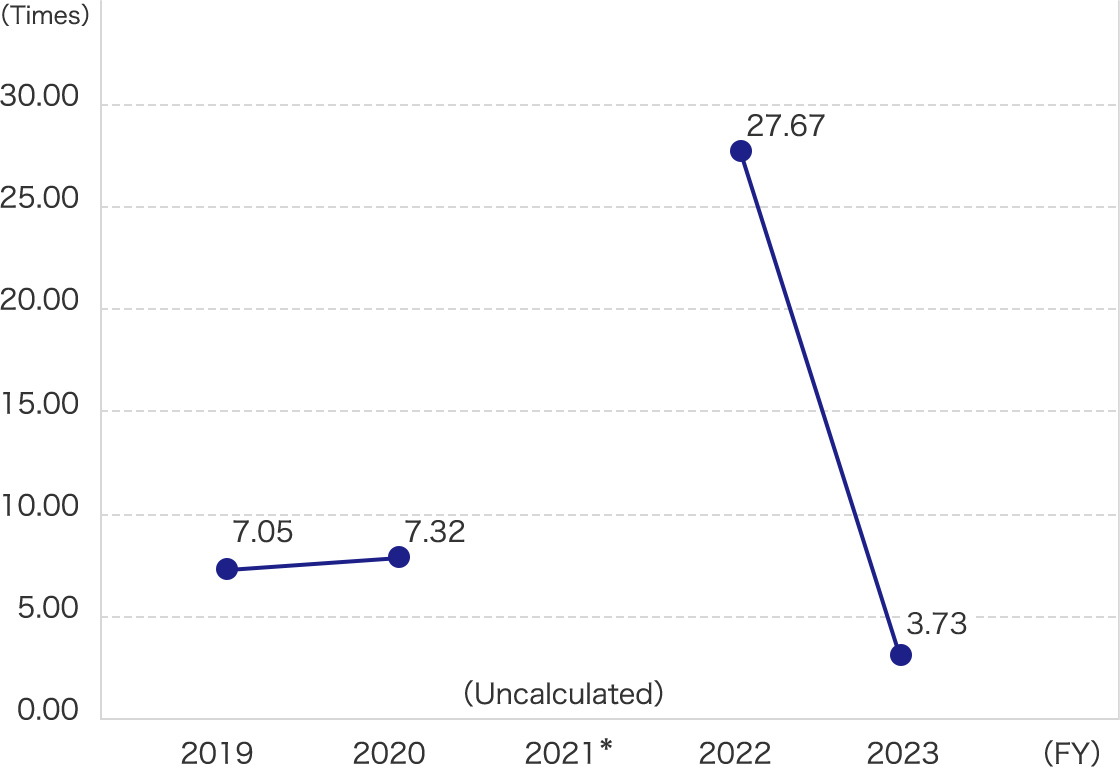

| PER (Price Earnings Ratio) |

|---|

|

*PER was not calculated in which net loss was redorded in FY2021.

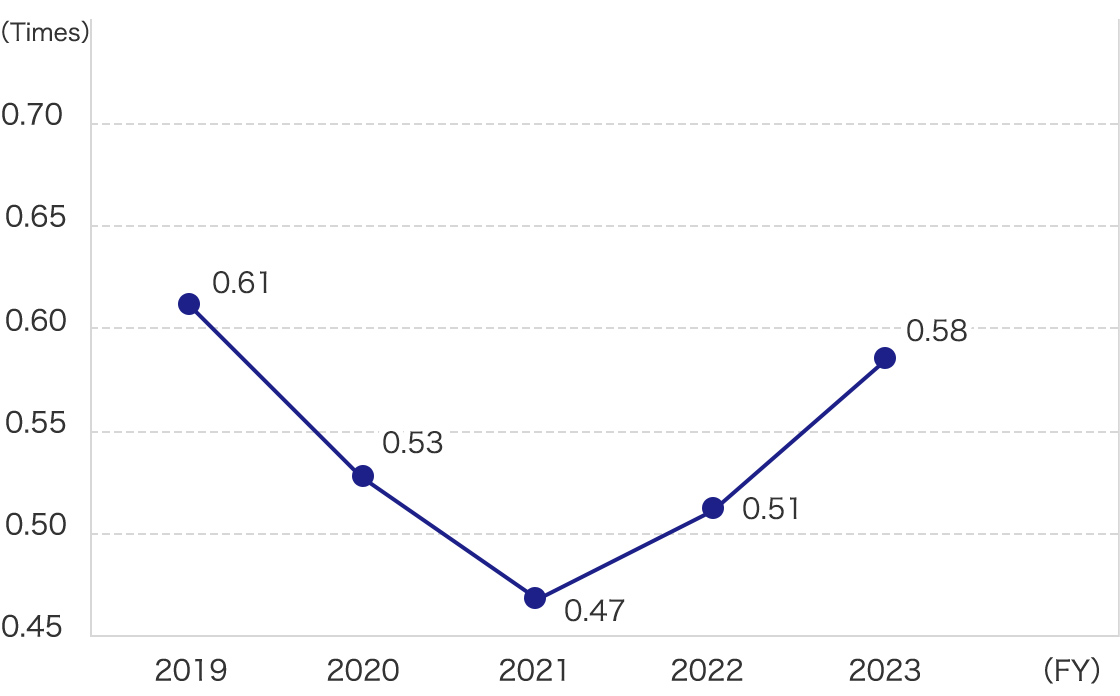

| PBR (Price Book-value Ratio) |

|---|

|

If you want to know in more detail, please refer to Investors' Data Book 2024.